best buy 401k rollover

The market price of gold and the condition of the coin are the main influences of the coins value. The 5 Best Retirement Plans for The Self Employed April 27 2022 Trustpilot.

How To Rollover A 401k Into An Ira Nextadvisor With Time

People typically buy bullion coins in bulk and hold them as investments.

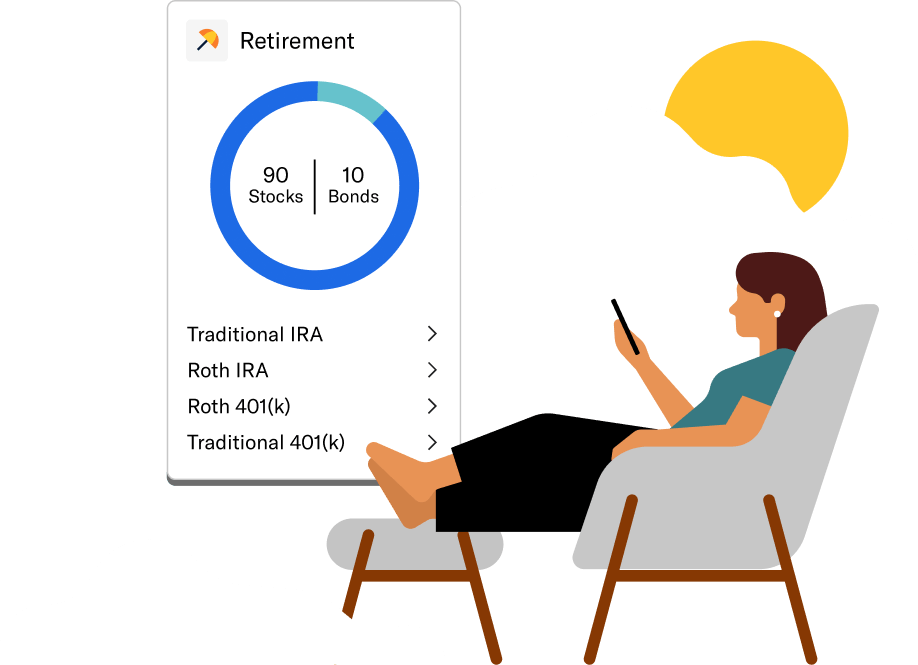

. A Gold IRA rollover is when you convert part of an existing retirement account or investment portfolio ie 401k Roth IRA SEP IRA into gold coins or bullion bars as a hedge against economic uncertainty and inflationDuring a rollover funds are withdrawn from the existing account and can be held for no longer than 60 days until they must. Reasons to Roll Your IRA Into Your 401k A reverse rollover occurs when you transfer retirement assets from an IRA that you manage to your current employers 401k plan. It appears that you can rollover a 401k into your Schwab solo 401k but you cannot do an IRA rollover.

Of course its best to max out both your 401k and Roth IRA as soon as you can. If your new employer doesnt have a retirement plan or if the portfolio options arent appealing consider staying in your old. Buy the 401K Averages Book.

Can my Solo 401k buy real estate. You sign up for your zip codes and these exclusive insurance leads investment leads financial planning leads social security leads 401k rollover leads and other lead types- see above. Your Solo 401k can buy Bitcoin Ether Litecoin Dash and thousands of other cryptocurrencies.

While IRAs generally enjoy fewer legal protections than 401k plans the owner of an IRA cannot borrow money from the account unlike a 401kThe age at which an IRA owner can take distributions is also greater than someone with a 401k who. Consumers who respond to the ads matching your products services and selected zip codes are passed on to you. Drawbacks of an In-Service 401k Rollover.

The drawbacks of an in-service rollover mirror that of a regular rollover. If the payment is made to you in the indirect rollover 11000 is. When considering a rollover of any variety it may help to work with a financial advisor who can guide you on your path to retirement.

Best online brokers for a 401k rollover. And its better than a self directed IRA because your Solo 401k is exempt from taxes on leveraged real estate profits. A 401k rollover is a transfer of money from an old 401k to another 401k or an IRA.

Heres how to do a 401k rollover in 4 steps without a tax bill. The general rule. The Best Robo-Advisors Of 2022.

These are the best quality gold coins minted in the United States. Find out whether your new employer has a defined contribution plan such as a 401k or 403b that allows rollovers from other plansEvaluate the new plans investment options to see whether they fit your investment style. Most of us will be in the lower tax bracket after retirement.

No rollover while working Workers generally arent allowed to take money out of their 401k plan accounts while theyre. Can you borrow from an inherited IRA. When you moved your 401k into a Traditional IRA that was called a Direct Rollover Now if you move your new Traditional IRA into a second Traditional IRA that is called a Direct Transfer When you buy the annuity the insurance company sets up your account as a Traditional IRA.

If you havent thought about how youre going to withdraw funds its time to start planning. If youre a buy-and-hold long-term investor Vanguard is an. Thats the best of both worlds.

In conclusion its better to max out your 401k first then work on the Roth IRA. Proof Coins Proof coins are valued based on the method of their manufacturer. An inherited IRA is the one IRA type that doesnt allow contributions or 60-day rule transactions.

A gold IRA often comes with higher fees than a traditional or Roth IRA that invests solely in stocks. The 401k Averages Book is the only resource available for non-biased 401k fee information comparison designed for financial service professionals. What is a Gold IRA Rollover.

Its the fastest growing asset class in the world and you can tap into a market that has grown over 1000 in the past year using your Solo 401k. Fund your Solo 401k with a rollover or contribution. Schwab does offer a lot of investing options including Vanguard mutual funds and commission free ETFs.

How To Buy Stocks Online For Free. The Best Self-Directed IRA Providers. Youve saved for decades and now youre about to retire--congratulations.

Companies that buy direct can eliminate the middleman allowing them to reduce their markup. Assuming your 401k plan is good its best to go with the 401k first. Using a direct rollover 55000 transfers from your plan at your old job to the one at your new job.

Advisors rely on 401k Averages Book data to populate parts of their IRA rollover recommendation and SECs Regulation Best Interest forms sec reg bi.

401 K Rollover To Ira Forbes Advisor

10 Big 401k Plans Suspending Matching Contributions In 2020 401 K Specialist

How You Can Leverage Your 401 K To Buy A Franchise

How To Launch A Successful Roll Over A 401k To A Gold Ira

Gold Ira Rollover Guide How To Execute 401 K Rollovers To Gold Paid Content Cleveland Cleveland Scene

How To Rollover An Old 401 K The Motley Fool

The Best Ira Rollover Offers Are Not What They Appear

How To Roll Over Your 401 K To A New 401 K Forbes Advisor

401 K Rollover How To Roll Over A 401 K

How To Buy Gold 401k Hot Sale 56 Off Www Ingeniovirtual Com

Roll Over A 401k Or Ira Rollovers

Top 4 Reasons To Roll Over Your Old 401k To An Ira Finpowered Female

401k Rollover To Ira Sjb Global

How To Execute A 401 K To Gold Ira Rollover Smartasset

Everything You Need To Know About 401 K S Money

Roll Over A 401k Or Ira Rollovers

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

Why You Should Reconsider An Indirect 401 K Rollover The Motley Fool